Basic mindset on corporate governance

Macromill Group has established the 'Macromill Code of Conduct' as the foundation of corporate rules which the officers and employees shall observe in their daily work. The Macromill Code of Conduct sets forth, based on its management principles, the detail code of conduct with the pillars of the 'Compliance with the laws and regulations, etc.', 'Proper relation with the society', 'Respect of human rights', and 'Sincere corporate activities', in accordance with the policy that it is essential for the proper and sound development of Macromill that all of its officers and employees (including full-time workers, contract workers, part-time workers, part-time workers with expertise, temporary workers, and seconded workers; the same hereinafter) fully recognize their necessary social responsibility in the various corporate activities, and act in compliance with the social ethics.

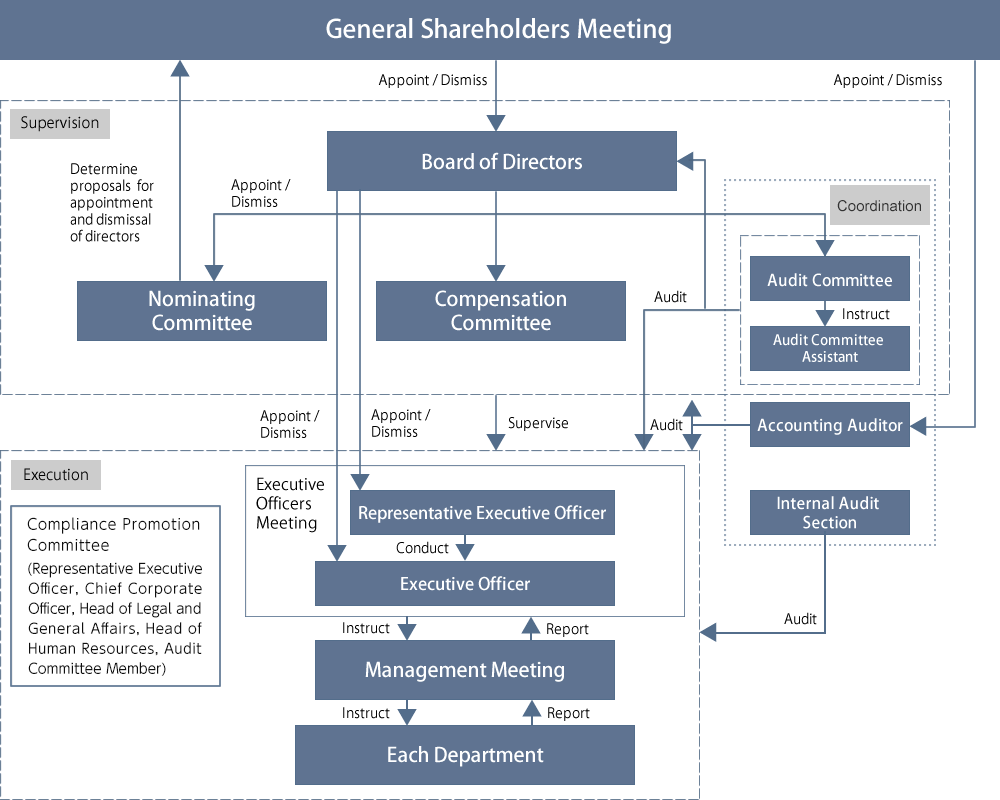

Macromill Group plans to fully establish its corporate governance system and continue to review and expand it, in order to realize its sound and transparent corporate management based on the Macromill Code of Conduct.

Take actions to enable management with an awareness of capital costs and share price

Macromill uses revenue, operating profit, and operating profit margin as key management indicators with the aim of increasing profit and expanding its profit margin by continuously growing revenue. It uses ROE linked to operating profit as one of the important indicators of capital efficiency.

ROE was 9.9% in the fiscal year ended June 30, 2021, 10.3% in the fiscal year ended June 30, 2022, and 21.8% in the fiscal year ended June 30, 2023. The result of fiscal year ended June 30, 2023 reflected a sum of 5,796 million yen recognized as net income (NI) attributable to owners of the parent of discontinued operations through the sale of overseas businesses (ex-Korea). ROE was 5.9% in the fiscal year ended June 30, 2024, partially due to loss from an equity method affiliate.

Macromill expects that ROE could exceed the cost of shareholders' equity if a double-digit level of ROE could be consistently maintained. In the Mid-term Business Plan ending in the fiscal year ending June 30, 2026, Macromill has set an ROE target of at least 10%, aiming to improve ROE by raising earning power while being conscious of an increase in equity spread.

Meanwhile, the PBR had been above 1x until the fiscal year ended June 30, 2022, but has been below 1x in the fiscal years ended June 30, 2023 and June 30, 2024. We judge that improving our earnings capacity is our most important task.

In our consolidated balance sheet, large amounts of internally generated goodwill are recorded in connection with LBO deals we implemented in the past, and we recognize that ROIC calculated from invested capital in relation to our business is greatly surpassing WACC.

In addition, we have been strengthening shareholder returns while keeping capital cost and share price in mind, by increasing the target dividend payout ratio from the previous 30% to a consolidated dividend payout ratio of 50% until the fiscal year ending in June 30, 2026, excluding the gain/loss on sales of securities and other one-off profit/loss, and by changing our policy to the realization of progressive dividend policy.

In the Mid-term Business Plan announced by Macromill, revenue growth (three-year compound annual growth rate (CAGR)) of 9% and an increase in operating profit (three-year CAGR) of 19% have been set as targets. Macromill will steadily achieve revenue and profit growth to reach its targets, maintain stable shareholder return, and improve IR activities, leading to the assessment of appropriate corporate value and an increase in PBR.

The Mid-term Business Plan of Macromill is found on the website below.

https://group.macromill.com/ir/medium_term_plan.html

Status of discussion with shareholders

Macromill strives to maintain appropriate, timely and fair information disclosure to help shareholders and investors understand our business activities and financial status and ensure reasonableness in their judgments.

We are also making efforts for fair disclosure, by disclosing major information simultaneously in Japanese and English.

To promote a constructive discussion with shareholders and investors, Macromill has established a disclosure policy which is posted on its webpage and communicates with equity markets as appropriate.

At the time of financial results announcements, Representative Executive Officer, CEO and Executive Officer, CFO & CGO hold quarterly business results briefing and Q&A sessions for institutional investors.

Feedback and requests expressed in discussion are reported to the Board of Directors and the management meeting as appropriate.

Results of activities in fiscal year ended June 30, 2024

Discussions with shareholders/investors |

Main speaker |

Overview of shareholders |

Number of times |

|---|---|---|---|

|

General Meeting of Shareholders |

All Directors and Executive Officers |

Individual shareholders |

1 |

|

Briefing on Financial Results for Analysts and Institutional Investors |

Representative Executive Officer, CEO Executive Officer, CFO, CGO |

Securities companies and institutional investors (fund managers, analysts and persons in charge of ESG) in and outside Japan |

4 |

|

Individual / small group meetings with analysts and institutional investors |

Representative Executive Officer, CEO Executive Officer, CFO, CGO Executive Officers, IR Office |

Securities companies and institutional investors (fund managers, analysts and persons in charge of ESG, persons in charge of exercise of voting rights, and others) in and outside Japan *The frequency of meetings is shown regardless of the number of participating persons (companies). |

120 |

|

Appearances in events and media |

Representative Executive Officer, CEO |

Individual shareholders |

3 |

*IR Office attended all discussions.

System for communicating feedback to management team

Details |

Frequency |

Reporting |

|---|---|---|

|

Reports on results explanations and investors views |

As needed |

Management team receives reports in report formats, in addition to direct reports or activity reports |

|

Stock-related information |

As needed |

Management team and Directors directly and promptly receive reports as appropriate at the time the shareholder composition is confirmed, when reports on large shareholdings, changes in large shareholdings, etc. are submitted, when analysts’ reports are published, or on other occasions. |

|

Reports on IR strategies and activities |

As needed |

The management team receives reports on status of IR activities, summaries of discussion, special notes, etc. orally or in report format. |

|

System of reporting to the Board of Directors |

Quarterly |

The Board of Directors receives reports from Representative Executive Officer, CEO and Executive Officer, CFO&CGO, and Head of IR Office. |

Topics incorporated in disclosure documents, including main themes of discussions, topics of interest and feedback from shareholders and investors.

Main themes of the discussion Points of interest from shareholders and investors |

Topics incorporated in disclosure documents based on discussions and feedback from investors |

|---|---|

|

・We hope to have materials for investors who intend to invest in Macromill for the first time (“first-time investors”) to understand Macromill’s business in full detail |

・We have prepared and disclosed the company brochures and materials that show our business models and competitive advantages for first-time investors on our website |

|

・The nature of your business is complicated and hard to understand, because segmentation information disclosed does not match the actual situation ・We ask that you rearrange your segmentation ・We ask that you establish KPIs for tracking the progress of each business ・When you establish KPIs, it is desirable that they allow checking on rises in operating profit in line with improvement in productivity |

・We separated the segments for Japan and Korea and visualized cost and earnings structures for each segment ・Regarding our business in Japan, we have created three categories according to characteristics of each business; namely Focus Business, Future Business and Foundation Business, and clarified strategies for each area ・We have established KPIs for each area for tracking profitability and productivity, and will explain progress of each business |

|

・Large amounts of internally generated goodwill are recorded on the balance sheet in connection with past LBO deals, and it is difficult to understand the actual status |

・We will disclose the breakdown of internally generated goodwill and other goodwill on financial results materials ・We have defined ROIC calculated from invested capital, excluding after-tax business profit and internally generated goodwill, and clearly indicate that our business management is highly efficient |

Towards expanding discussion with shareholders and investors from the next fiscal year onwards

To expand discussion with shareholders and investors in the next fiscal year and onwards, we will continuously increase opportunities for discussion with shareholders and investors in addition to results briefing sessions and general shareholders meetings, bolster our IR structure and plan to run IR activities outside Japan and hold small meetings for investors and analysts.