Medium-term management plan

The Group disclosed in August 2021 an MTBP (Mid-term Business Plan) for the three years leading up to the fiscal year ending June 30, 2024. Subsequently, the Group formulated a new MTBP for three years from the fiscal year ending June 30, 2024 to the fiscal year ending June 30, 2026, which reflects the effects of the transfer of the Overseas (ex-Korea) Business and the current business environment.

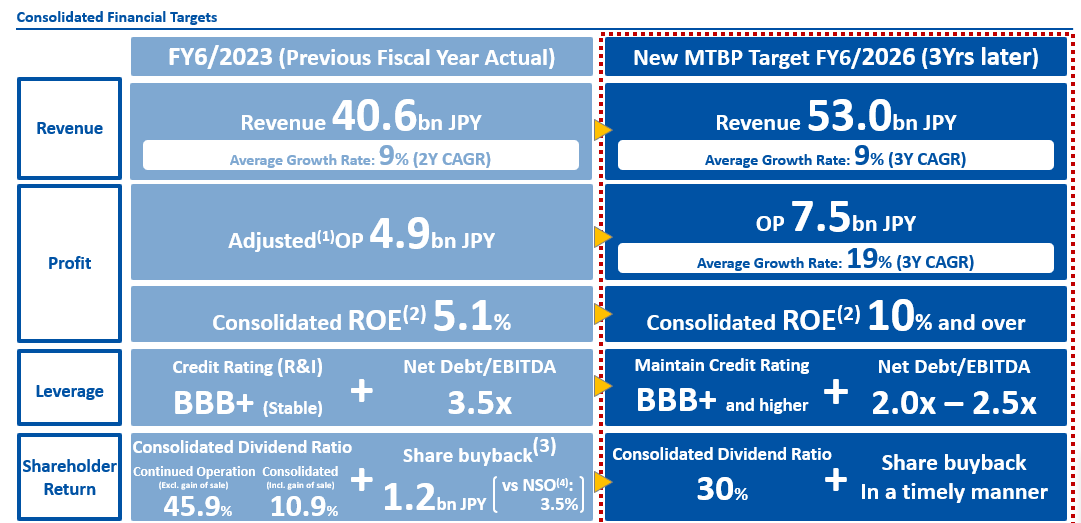

The financial targets stated in the new MTBP include consolidated revenue of 53.0 billion yen and consolidated operating profit of 7.5 billion yen. The Company aims to achieve a record profit. In addition, the target level of financial leverage will remain the same as previously, and the Company will aim to control its Net Debt/EBITDA ratio between 2.5x and 2.0x range while maintaining its existing credit rating. Regarding the shareholder’s return policy, the Company changes its policy. By the end of FY2026/6, which is the final year of the MTBP, the Company will increase the shareholder's return from 30% of the consolidated dividend payout ratio to 50% (excluding the effects of one-time gains and losses such as from the sale of shares) for the progressive increase in dividend of surplus with the number of dividends per share either increased or sustained (Released on August 14th, 2024: Notice Regarding Change of Dividend Policy ). In addition, regarding the purchase of treasury stock, the Group plans to consider it flexibly as part of its profit distribution measures, comprehensively taking into account our business development, investment plans, level of retained earnings and trends in business performance.

Notes

(1) Including expenses related to the transfer of overseas subsidiaries (M&A)

(2) Calculated by excluding expenses on FY2023/6 related to the transfer of overseas subsidiaries (M&A)

(3) ROE: Return On Equity Return on Equity Attributable to Owners of Parent for Continuing Operations

(4) Period of acquisition:May 16, 2023 – June 23, 2023

(5) NSO: Number of Shares Outstanding

In the Japan Business, the Group’s flagship business, the Company will focus on restoring the growth of the online research and digital research businesses which are profitable. To develop the businesses that will drive sales and profit, the Company will expand business in Asia and strengthen global research. The Company will also develop data utilization support (data consulting) and subscription type solutions. The Company will accelerate the transformation of its business model to increase its presence as a Professional Marketing Services Company. Through these business activities, the Company aims to record revenue of 46.0 billion yen (a three-year CAGR of 10%) in 2026.

In the Korea Business, the Company will start the development of a service based on the data from the proprietary consumer panel in earnest. This includes providing purchase data, which the Company has already started to provide in Japan. The Company aims to post revenue of 7.0 billion yen (a three-year CAGR of 7%) in 2026.

While expanding revenue, through redefining added value and the scope of services, reviewing prices, improving research processes and revamping the core research system, the Company will take steps to increase operational efficiency and productivity to maximize earnings.